Introduction to GameStop’s Investment

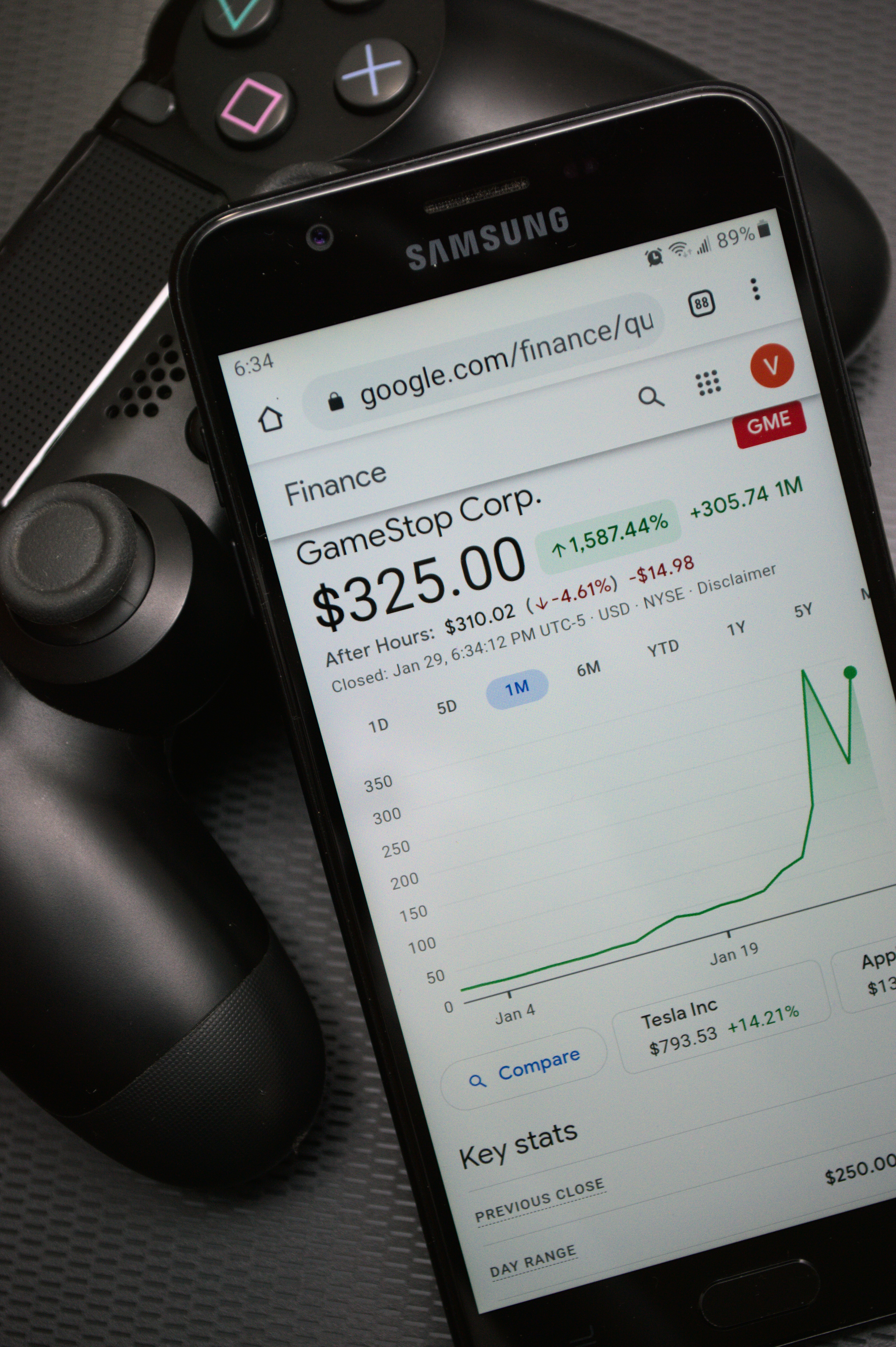

GameStop, the well-known video game retailer that gained notoriety during the meme stock phenomenon, has made headlines once again by announcing a substantial $500 million investment in Bitcoin. This bold move underscores the company’s strategic pivot towards embracing digital transformation and leveraging new technologies to position itself favorably in an evolving market. The decision represents not just a financial investment, but also a broader initiative aiming to solidify GameStop’s presence within the rapidly advancing landscape of cryptocurrencies.

The rationale behind this significant investment is multifaceted. GameStop aims to enhance its overall business model by transitioning from a traditional retail setup into a more tech-focused entity. By investing in Bitcoin, GameStop not only diversifies its asset base but also aligns itself with an emerging financial ecosystem that resonates with younger consumers and tech-savvy investors. This demographic, which has shown increasing interest in cryptocurrencies, could play a pivotal role in GameStop’s efforts to attract a new generation of customers and shareholders.

Furthermore, GameStop’s maneuver comes at a time when the gaming industry is undergoing substantial changes, with a growing emphasis on digital sales and online gaming experiences. Investing in Bitcoin is indicative of the company’s strategic objectives to integrate digital assets into its operations. This shift not only enhances its market competitiveness but also reflects a proactive response to contemporary trends where cryptocurrencies are becoming part of mainstream financial discussions.

In essence, GameStop’s investment in Bitcoin signifies a transformative approach to business strategy, merging traditional retail with cutting-edge technology. The potential benefits of this initiative could be transformative for the company, reinforcing its commitment to innovation while navigating an increasingly competitive market landscape.

Understanding Bitcoin and Its Market Dynamics

Bitcoin, created in 2009 by an anonymous person or group under the pseudonym Satoshi Nakamoto, is the first decentralized cryptocurrency. As a digital asset, it operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers. Unlike traditional currencies issued by governments, Bitcoin is not controlled by any central bank, making it a revolutionary monetary system.

The volatility of Bitcoin is one of its defining characteristics. Since its inception, Bitcoin has experienced significant price fluctuations, often influenced by market sentiment, regulatory news, technological advancements, and macroeconomic factors. For instance, Bitcoin’s price surged to an all-time high of nearly $65,000 in April 2021, followed by sharp declines, illustrating the erratic nature of its market dynamics. This volatility presents both opportunities and risks for investors, making it a highly speculative asset.

In recent years, the cryptocurrency market has seen a growing interest from institutional investors, which has contributed to Bitcoin’s robustness as an investment option. Financial giants and corporate entities are increasingly recognizing Bitcoin’s potential as a hedge against inflation and a store of value, akin to digital gold. Furthermore, innovations in financial products based on Bitcoin, such as exchange-traded funds (ETFs), have made it more accessible to a broader range of investors.

However, despite its strong appeal, investing in Bitcoin carries inherent risks. The regulatory landscape surrounding cryptocurrencies is still evolving, and potential regulations could impact market dynamics significantly. Additionally, the high volatility may lead to substantial financial losses for those who are not well-prepared or informed about the market.

As such, understanding Bitcoin’s market dynamics and the factors influencing its price fluctuations is critical for any investor considering engagement with this digital asset. It is essential to approach Bitcoin investments with caution, informed by comprehensive research and an awareness of the risks associated with cryptocurrency markets.

Implications of GameStop’s Bitcoin Investment

GameStop’s recent strategic decision to invest $500 million in Bitcoin is poised to have far-reaching implications, both for the company itself and the broader market. As a company traditionally viewed through the lens of physical retail and gaming, this bold move signals a shift towards embracing digital assets and modern monetary frameworks. This could transform GameStop into a more resilient entity, capable of navigating the challenges faced in the retail sector.

One immediate consequence of GameStop’s foray into Bitcoin is the potential impact on its stock price. Investor sentiment may shift positively, particularly among those who value innovation and adaptability in a corporation. The cryptocurrency market, often characterized by volatility, may introduce new dimensions to GameStop’s asset portfolio. If Bitcoin appreciates in value, this could bolster GameStop’s financial standing and invigorate its share price, reflecting a more progressive stance in an evolving financial landscape.

Furthermore, the ripple effect of this investment could influence other companies within the gaming and retail sectors. As GameStop embraces cryptocurrency, competitors may feel compelled to explore similar paths. This could lead to a broader acceptance of Bitcoin and other cryptocurrencies in corporate portfolios, thereby enhancing the legitimacy of digital currencies as viable financial assets. Additionally, it may attract a demographic of investors who are enthusiastic about the convergence of gaming and digital finance.

In essence, GameStop’s entry into the Bitcoin market could serve as a catalyst for change. By adopting cryptocurrency as part of its investment strategy, GameStop positions itself at the forefront of a potential shift in the market dynamics of not only gaming but also retail as a whole. Observers will be keenly watching how this venture unfolds, given its potential to reshape investor attitudes and market perceptions in an increasingly digital economy.

Future Outlook: GameStop and Cryptocurrency

GameStop’s recent decision to invest $500 million in Bitcoin marks a significant shift in the company’s strategic approach, positioning it at the intersection of traditional retail and the burgeoning cryptocurrency market. This investment not only aligns with the growing trend of digital asset diversification among corporations but also indicates a proactive stance in exploring new revenue streams. By enhancing its balance sheet with Bitcoin holdings, GameStop is poised to navigate the increasingly volatile market conditions more adeptly, leveraging potential upswings in cryptocurrency value to support its core business operations.

Looking ahead, GameStop may explore potential partnerships within the cryptocurrency ecosystem that could further bolster its brand and operational capacities. Collaborations with blockchain technology companies are plausible, particularly in areas such as online gaming and digital collectibles, which can resonate with its existing customer base. The incorporation of non-fungible tokens (NFTs) and virtual goods into its retail offerings appears to be a strategic avenue for engaging younger consumers who are increasingly inclined to transact in digital currencies. Such initiatives could solve existing revenue challenges while fostering customer loyalty.

The broader implications of GameStop’s move into cryptocurrency also illuminate the evolving relationship between traditional companies and digital assets. As cryptocurrencies continue to gain traction among investors and consumers alike, it is likely that more retail giants will follow GameStop’s lead. This could potentially lead to a paradigm shift in how companies view their financial strategies, with cryptocurrency becoming a standard asset class within corporate portfolios. In light of this dynamic landscape, GameStop’s entry into the cryptocurrency realm may well serve as both a benchmark for others and a foundation for its long-term growth and adaptability amidst a rapidly changing market.